Secular bear markets destroys wealth, but advisors rarely explain them to clients as that would not be good for the advisor's business (commissions).

The pages linked below are critically important to your financial well-being. Please, click on them and print them out.

John Maynard Keynes: "A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him."

John Maynard Keynes: "A sound banker, alas, is not one who foresees danger and avoids it, but one who, when he is ruined, is ruined in a conventional and orthodox way along with his fellows, so that no one can really blame him."Sukh's Thoughts: I believe this also applies for financial advisors and how they manage people's life savings. Buy-and-hold-and-buy-some-more-on-the-dips worked very well for everyone in a secular bull market, but in a secular bear market, investors will get killed, while "advisors" continue to "earn" their commissions.

Advisors will do what they have to do to put food on their own families' tables, that is just human nature. And, they have the cover of being able to say that they are only doing as they have been trained. Unfortunately, all their training assumes a never-ending secular bull market and an economy where incomes are always rising and interest rates are always falling.

This is no longer the reality we live in.

Advising clients in a secular bear market is not something most financial advisors are qualified, or prepared to do, so they keep their blinders on, and make no effort to educate themselves or their clients of this new reality. Besides, doing so would only open them up, to not only losing business (because they would have to tell their "clients" things they need to know, but do not want to hear), but also to lawsuits for negligence. By sticking with the buy-and-hold, think long-term approach, they at least have the legal cover of being able to say, "Nobody saw it coming!"

Jeremy Grantham: "Career risk drives the institutional world. Never, ever be wrong on your own. You can be wrong in company; that's okay. For example, every single CEO of, say the 30 largest financial companies failed to see the housing bust coming and the inevitable crisis that would follow. Naturally enough, "Nobody saw it coming!" But in general, those who danced off the cliff had enough company that, if they didn't commit other large errors, they were safe; missing the pending crisis was far from a sufficient reason for getting fired."

Jeremy Grantham: "The surge of bailout money certainly prevented the market from going as low this time as would have been justified by the severity of the crisis. Based on history, an appropriate decline would have been into the 400s or 500s on the S&P.

Sukh's Thoughts: The next time the market crashes (maybe sooner than most people realize), and interest rates are already low, there will be nothing to inflate the market back to bubble valuations. And this time around, investors will be told that they really should have known better (based on what happened just a few years earlier and the fact that we are in the middle of a once-in-a-lifetime financial/credit crisis), and the losses incurred are the risk you take when investing in corporate equities and bonds.

A Minsky moment is the point in a credit cycle or business cycle when investors have cash flow problems due to spiraling debt they have incurred in order to finance speculative investments. At this point, a major selloff begins.

Charles Ferguson: "There has evolved a political duopoly in the United States, in which the two political parties agree to agree on certain things and agree to disagree on others. And, in particular, they agree on things related to finance and money and they disagree on social policy....My quite strong sense is that this is something that is now explicitly understood.

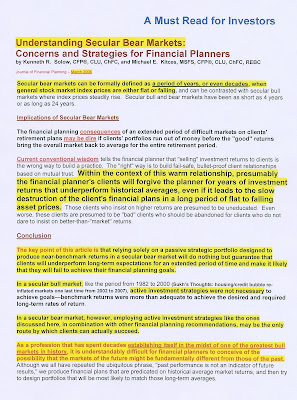

A secular bear market can last between ten to twenty years, with the market worth less at the end of all these years than it was at the beginning.

Buy-and-hold works in a secular bull market. It fails miserably in a secular bear market.

Finacial advisors are salespeople that pay their bills by selling products, not advice. There is often a huge agency problem that is never mentioned to "clients". How else could they possibly recommend a buy-and-hold strategy in a market where the long-term trend is down?

The question is, in a secular bear market, and especially when we are currently in the middle of a once-in-a-century financial crisis, who exactly is best served by such a superficial level of advice?

The question is, in a secular bear market, and especially when we are currently in the middle of a once-in-a-century financial crisis, who exactly is best served by such a superficial level of advice?

Why are financial advisors not properly educating their clients?

Why are financial advisors not properly educating their clients? Investors need to be better informed so that they can make more prudent investment choices when it comes to preserving their life's savings in a secular bear market.

This is the right thing to do, but it's very bad for business in the investment "sales" industry!

Debt default, deleveraging, and asset-price deflation will have an immensely negative effect on the value of people's investments? (especially after all the different mutual fund fees for "professional management" are taken into account)

Debt default, deleveraging, and asset-price deflation will have an immensely negative effect on the value of people's investments? (especially after all the different mutual fund fees for "professional management" are taken into account) According to the debt deflation theory, a sequence of effects of the debt bubble bursting occurs:

1.Debt liquidation and distress selling.

2.Contraction of the money supply as bank loans are paid off.

3.A fall in the level of asset prices.

4.A still greater fall in the net worth of businesses, precipitating bankruptcies.

5.A fall in profits.

6.A reduction in output, in trade and in employment.

7.Pessimism and loss of confidence.

8.Hoarding of money.

9.A fall in nominal interest rates and a rise in deflation adjusted interest rates.

Please, get better informed!

Live, Love, Laugh, Learn, Leave a Legacy!

The content on this site is provided as general information only and should not be taken as investment advice. All site content shall not be construed as a recommendation to buy or sell any security or financial product, or to participate in any particular trading or investment strategy. The ideas expressed on this site are solely the opinions of the author.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.